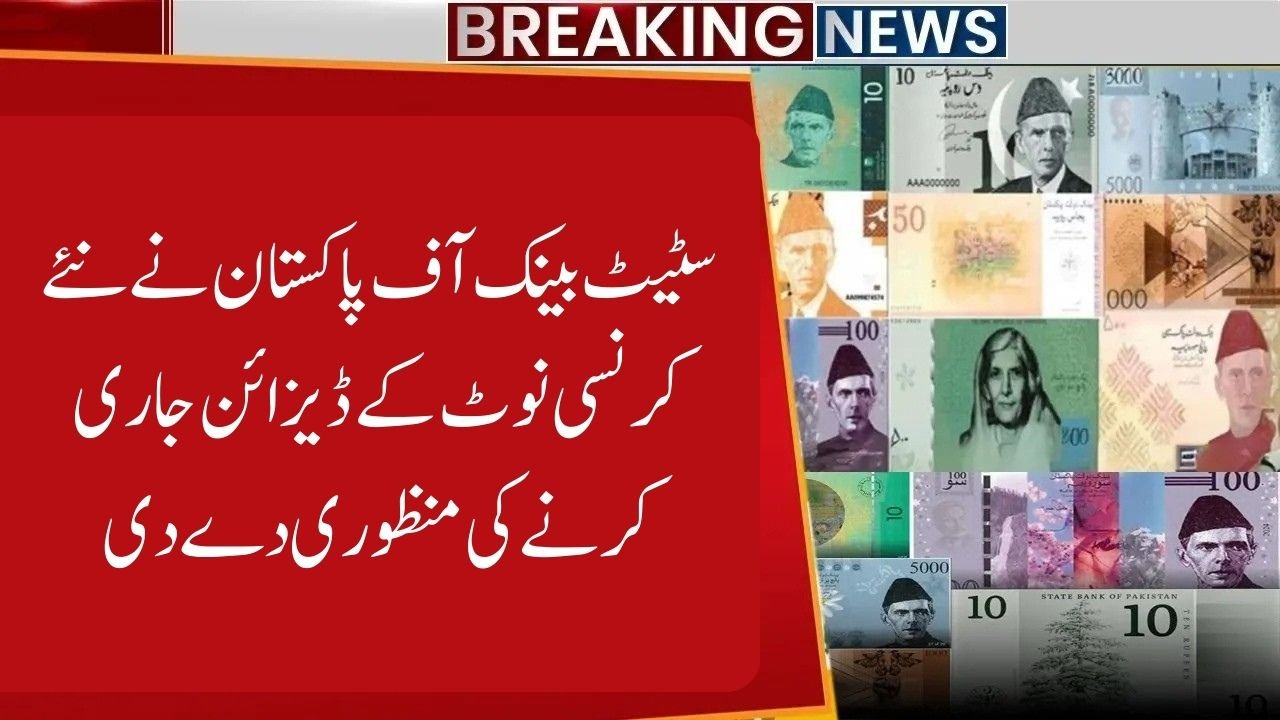

State Bank of Pakistan Approves New Currency Note Designs 2026

State Bank of Pakistan Approves New Currency Note Designs

Pakistan’s financial system is moving toward a major update as the State Bank of Pakistan confirms new currency note designs for 2026. The decision aims to improve security, reduce counterfeiting, and modernize the country’s cash system. Many citizens were worried about rumors regarding note replacement and the future of high-value currency. With official statements now released, people finally have clarity about when new notes may arrive and what changes to expect in the coming years.

Also Read ; BISP 8171 Web Portal Balance Check Online February 2026

| Key Update | Details |

|---|---|

| Authority | State Bank of Pakistan |

| Announcement Year | 2026 |

| Design Status | Approved by SBP Board |

| Next Step | Ministry of Finance clearance |

| Rs. 5,000 Note | Will continue |

| Main Goal | Security and modernization |

| Public Impact | Gradual rollout expected |

| Source | Official website |

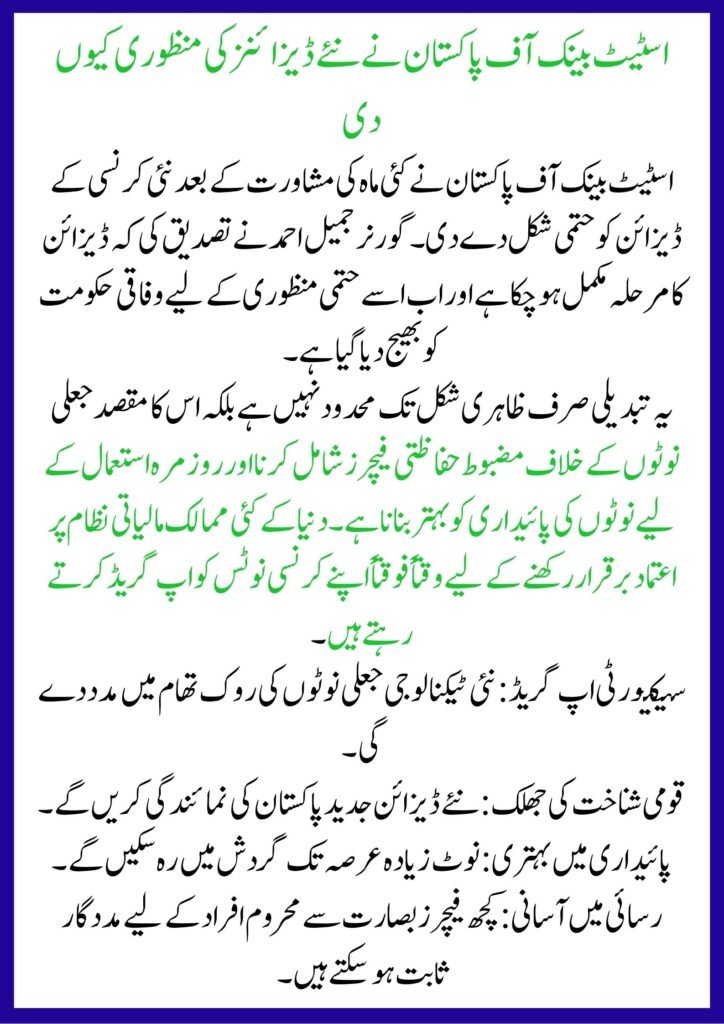

Why the State Bank of Pakistan Approved New Designs

The State Bank of Pakistan finalized new currency concepts after months of discussion. Governor Jameel Ahmad confirmed that the design phase is complete and has been sent to the federal government for final approval.

The redesign is not only about appearance. It focuses on stronger anti-counterfeit features and improving durability for everyday use. According to information from the official website and summaries from top 10 Google sources, many countries regularly upgrade notes to maintain trust in the financial system.

- Security upgrade: New technology helps prevent fake notes.

- National identity refresh: Updated visuals reflect modern Pakistan.

- Durability improvement: Notes last longer in circulation.

- Accessibility focus: Features may help visually impaired users.

When Will New Currency Notes Be Issued?

Many people think approved designs mean new notes will appear immediately. That is not the case. The process includes multiple legal and economic checks before printing begins.

Here is a simple step-by-step process expected next:

- Federal government reviews and approves designs.

- Printing arrangements are finalized.

- Public awareness campaigns start.

- Gradual circulation begins through banks.

This phased approach helps avoid panic withdrawals or confusion in markets. The State Bank of Pakistan wants a smooth transition so businesses and citizens feel secure using existing notes.

Rs. 5,000 Note Will Continue in Circulation

One of the biggest public rumors was that the highest denomination note might be removed. However, the central bank clearly denied this claim.

Governor Jameel Ahmad stated there is no proposal to discontinue the Rs. 5,000 note. This clarification matters because many traders rely on high-value cash transactions.

- Market stability: Businesses avoid sudden disruptions.

- Reduced panic: People do not rush to exchange notes.

- Financial confidence: Large payments remain easier.

The statement from the State Bank of Pakistan helps restore trust after months of speculation on social media.

Expected Security Features in the New Notes

Security improvements are the main reason behind the redesign. New features aim to make verification easier for the public while making counterfeiting more difficult.

- Watermarks: Advanced patterns visible under light.

- Security threads: Embedded lines for quick checking.

- Color-shifting ink: Changes color when tilted.

- Raised printing: Helps recognition through touch.

These features follow global standards used by many modern central banks. Information about security upgrades comes from the official website and analysis of top Google sources discussing currency reforms.

Senate Finance Committee Meeting and Tax Concerns

The currency update was discussed during a Senate Standing Committee on Finance meeting. While the new note designs gained attention, the session also highlighted tax policy debates.

Senator Abdul Qadir raised concerns about super tax recovery methods. Lawmakers said heavy pressure on businesses could reduce investment and increase unemployment.

- Lump-sum tax demands: Businesses struggle with sudden payments.

- Multiple-year coverage: Companies face large financial burdens.

- Aggressive recovery tactics: Phone calls and SMS notices criticized.

Senator Sherry Rehman added that repeatedly taxing the same groups may hurt long-term revenue growth. Meanwhile, the FBR Chairman said instalment options could be allowed in some cases.

Digital Outreach and Growing Tax Registration

During the meeting, the Finance Minister shared that digital communication has improved tax registration results. Automated SMS messages reportedly encouraged many new taxpayers to register.

- One million new taxpayers joined after SMS campaigns.

- Automated calls increased awareness quickly.

- Digital reminders proved more effective than strict enforcement.

This shows how modern digital tools can support financial reforms alongside currency updates led by the State Bank of Pakistan.

Helpline & Contact Information

Citizens who want official updates or clarification can contact the central bank through publicly available channels listed online.

Helpline & Contact Details (from Google and official listings):

- State Bank of Pakistan Helpline: +92-21-111-727-273

- Official Website: State Bank of Pakistan portal

- Email Support: info@sbp.org.pk

- Headquarters: I.I. Chundrigar Road, Karachi

Always verify information through official sources before believing online rumors about currency changes.

What Citizens Should Expect Next

The approval of new designs is only the beginning. People should continue using current notes without worry.

Short-term expectations:

- Government review and final authorization.

- No immediate change in daily transactions.

Medium-term expectations:

- Gradual rollout announcements.

- Public awareness campaigns from the State Bank of Pakistan.

Long-term expectations:

- Stronger security against fake currency.

- Improved reliability in cash payments.

Conclusion

The State Bank of Pakistan has taken a significant step by approving new currency note designs for 2026. While the notes will not appear instantly, the process signals modernization of Pakistan’s financial system. Clear confirmation that the Rs. 5,000 note will remain in circulation has reduced public fears. At the same time, discussions in the Senate about taxation show that economic reforms go beyond currency design. As approvals move forward, citizens should rely on official announcements and avoid spreading unverified claims about note changes.

FAQs

Is Pakistan getting new currency notes in 2026?

Yes, the State Bank of Pakistan has finalized designs, but government approval is still required before printing and circulation.

Will the Rs. 5,000 note be discontinued?

No. Officials confirmed there is no proposal to remove the highest denomination note.

When will new notes start circulating?

There is no exact date yet. The rollout will happen only after federal approval and preparation.

Why is Pakistan redesigning its currency?

The main reasons include stronger security features, reduced counterfeiting, improved durability, and updated national identity elements.

Latest Updates

Apni Zameen Apna Ghar Program Digital Balloting 2026 Completed for 2,000 Free Residential Plots in Punjab

Apni Zameen Apna Ghar Program Digital Balloting 2026 Completed for 2,000 Free Residential Plots in Punjab 3 Day Left to Apply in Punjab Laptop Scheme Phase 2 Registration

3 Day Left to Apply in Punjab Laptop Scheme Phase 2 Registration Check Online Married Status in NADRA CNIC Free – Instant Verification Guide 2026

Check Online Married Status in NADRA CNIC Free – Instant Verification Guide 2026 Current News: EOBI Pension Increase 2026 – Payment Schedule

Current News: EOBI Pension Increase 2026 – Payment Schedule How To Register For Nigehban Ramzan Card 2026 Online – Complete & Updated Guide

How To Register For Nigehban Ramzan Card 2026 Online – Complete & Updated Guide Latest News: CM Punjab Free Online Courses 2026 – Free Laptop, Interest-Free Loan & Work From Home Skills

Latest News: CM Punjab Free Online Courses 2026 – Free Laptop, Interest-Free Loan & Work From Home Skills