Current News! Zarkhaiz‑e‑Asaan Digital Loan Scheme 2026 – Get Rs 7 to 15 Lakh Without Interest

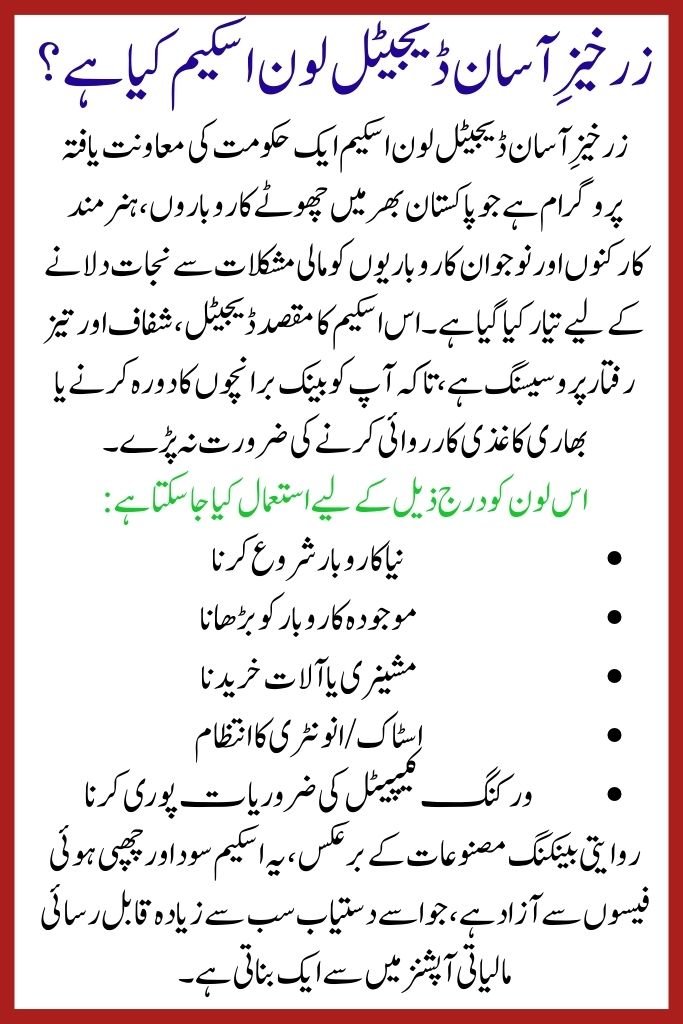

Zarkhaiz‑e‑Asaan Digital Loan Scheme

Looking for interest‑free funding to grow your business in Pakistan in 2026? The Zarkhaiz‑e‑Asaan Digital Loan Scheme offers entrepreneurs, freelancers, self‑employed individuals, and small business owners the chance to access Rs 7 lakh to Rs 15 lakh without any interest. Through a 100% digital application and transparent process, this initiative aims to remove barriers that often stop ordinary people from getting credit. Information in this article is compiled from the official scheme details and top 10 Google sources available online.

| Feature | Details |

|---|---|

| Loan Name | Zarkhaiz‑e‑Asaan Digital Loan Scheme |

| Loan Amount | Rs 7,00,000 – Rs 15,00,000 |

| Interest | 0% (No interest / no hidden fees) |

| Application | Fully Digital Online |

| Who Can Apply | Pakistani citizens, business owners |

| Documents | CNIC, business plan, bank details |

| Application Updates | Online + SMS/E‑mail |

| Official Source | Govt / Official Portal |

What Is the Zarkhaiz‑e‑Asaan Digital Loan Scheme?

The Zarkhaiz‑e‑Asaan Digital Loan Scheme is a government‑backed program designed to tackle financing challenges for small enterprises, skilled workers, and young entrepreneurs across Pakistan. It emphasizes digital, transparent, and fast processing, so you don’t have to visit branches or deal with heavy paperwork.

This loan can be used for:

- Starting a new business

- Expanding an existing business

- Buying machinery or equipment

- Managing inventory

- Covering working capital needs

Unlike traditional banking products, this scheme avoids interest and hidden charges, making it one of the most accessible financing options available.

Also Read ; How To Get 25000 Money From BISP Program 8171

Who Is Eligible to Apply?

Before you start your application, ensure you meet these basic criteria:

• Must be a Pakistani citizen with a valid CNIC

• At least 18 years old

• A small business owner, self‑employed individual, or entrepreneur

• Should have a clear business plan

• No default history in previous government loan programs

These conditions help ensure the loan supports people who are genuinely ready to use it for productive purposes.

Step‑by‑Step Digital Application Process

Here’s how the digital process works, step by step:

- Visit the official digital portal listed on the scheme’s official website.

- Register using your CNIC and mobile number.

- Fill in your personal and business details on the online form.

- Upload required documents (such as CNIC, business plan, and bank info).

- Submit and track your application status online.

After submission, you’ll receive updates via SMS or email, so you stay informed without needing to follow up in person.

Documents Required for Application

To speed up your approval, prepare the following:

- CNIC copy

- Proof of business or trade (if applicable)

- Bank account details

- Basic financial records

- A simple business plan

Having these ready makes your application process fast and smooth.

Key Benefits of the Scheme

The Zarkhaiz‑e‑Asaan Digital Loan Scheme stands out from other loan products because:

- Zero interest: You repay only the principal amount.

- No hidden fees: What you see is what you get.

- Fully digital: Apply, track, and manage online.

- Inclusive: Designed for urban and rural Pakistan.

- Simple eligibility: Not limited to big businesses.

- Transparent updates: Receive SMS or e‑mail progress alerts.

These advantages make it a practical financing choice for new and growing businesses.

Helpline & Contact (Official Sources)

At present, specific helpline numbers for the Zarkhaiz‑e‑Asaan Digital Loan Scheme 2026 are not widely listed online. For official assistance and help:

Contact your nearest Government Support Center

Visit the official loan scheme portal

Use live support/feedback form on the official website

Always use official channels listed on the government portal to avoid scams. Verify the link and details before sharing any personal information.

Be cautious of unauthorized or fraud loan advertisements online; the Securities and Exchange Commission of Pakistan (SECP) warns the public about fake loan promotions that ask for upfront fees these are scams.

Conclusion

The Zarkhaiz‑e‑Asaan Digital Loan Scheme 2026 offers a rare chance to secure interest‑free financing between Rs 7 lakh and Rs 15 lakh through a fully online application. Whether you’re launching a startup, growing a microbusiness, or need funds for equipment and inventory, this scheme opens doors to affordable financing. Remember to apply only through the official government portal or verified sources and be ready with your documents for a smooth experience.

Frequently Asked Questions (FAQs)

Is the Zarkhaiz‑e‑Asaan loan really interest‑free?

Yes according to the official scheme details, there is no interest or hidden charges on this loan for eligible applicants.

How long does the online application take?

Once submitted correctly, verification and approval can take a few days to weeks, depending on processing time.

Can women and youth apply for this loan?

Yes the scheme is designed for all eligible Pakistani citizens, including youth and women entrepreneurs.

Where will the funds be sent once approved?

Loan amounts are disbursed digitally into your bank account no need to visit offices.

Latest Updates

Today Update: Check Roshan Gharana Solar Panel Scheme Punjab Status via 8800 SMS 2026

Today Update: Check Roshan Gharana Solar Panel Scheme Punjab Status via 8800 SMS 2026 Breaking Update: Eligibility Criteria for CM Rashan Card Punjab – Complete 2026 Guide for Deserving Families

Breaking Update: Eligibility Criteria for CM Rashan Card Punjab – Complete 2026 Guide for Deserving Families Today’s Update: BISP 8171 Next Payment 2026 – How to Verify & Collect from Centers

Today’s Update: BISP 8171 Next Payment 2026 – How to Verify & Collect from Centers Breaking News! Punjab Solar Panel Scheme 2026 – Free 6 Solar Panels for Poor Families

Breaking News! Punjab Solar Panel Scheme 2026 – Free 6 Solar Panels for Poor Families Current News: PSCA E-Challan Punjab 2026 – How to Check Traffic Challan Online

Current News: PSCA E-Challan Punjab 2026 – How to Check Traffic Challan Online Breaking Update! Registration of Ramzan Rashan Relief Package Through 8070 Web Portal 2026 – Complete Online Guide for Families

Breaking Update! Registration of Ramzan Rashan Relief Package Through 8070 Web Portal 2026 – Complete Online Guide for Families